Assessment Based National Dialogue

SPF Good Practices Guide

Module 13

Objectives

This module aims to increasing knowledge on the concepts of affordability and fiscal space, as well as on the impact of expanding or implementing new social protection provisions on government budget. It also aims to provide ideas on various measures to increase fiscal space through budget reallocations or tax reforms. Finally, it aims to foster a discussion on ways to convince the government to increase fiscal space and invest in social protection.

Key questions

- What is affordability and fiscal space?

- How to forecast government revenues and expenditures?

- How to calculate fiscal space and finance fiscal deficit?

- How to convince governments to invest in social protection?

Takeaway message

Whereas the concept of affordability relates to the capacity of a country as a whole to finance additional social protection benefits, that of fiscal space indicates whether the government can afford financing these benefits from its own budget. Adding new social protection benefits will inevitably result in deteriorating the fiscal balance. Thus, ways to reduce the deficit need to be devised by increasing governmentâs resources or cutting âunnecessaryâ expenditures and reallocating the available resources to social protection. In any case, the government needs to understand that social protection shall not be considered as a cost but as an investment in human capital.

Resources

- Master module 13 - Assessing affordability and impact on fiscal space

- Presentation - Assessing affordability and impact on fiscal space

- Fiscal space and the extension of social security - lessons learnt from developing countries

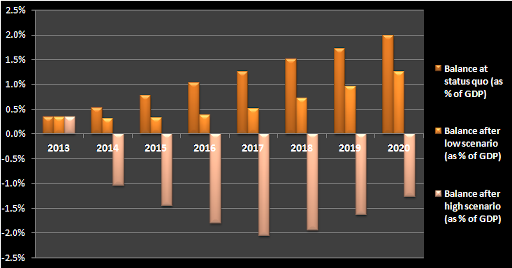

Cost of social protection recommendations as percentage of GDP in Coresia