Social Security (Minimum Standards) Convention, 1952 (No. 102)

Frequently Asked Questions

What is the difference between social security and social protection?

- For the ILO, the concepts of “social security” and “social protection” are used interchangeably and cover all measures aimed at providing income security and health care to all those who need them. This is usually achieved through social protection/security systems that provide benefits and services throughout the life cycle, especially in the event of sickness, disability, maternity, employment injury, unemployment, old age, death of an income providing family member, or in relation to childcare. These systems are to be built on the principle of social solidarity and thus collective financing, through contributory, non-contributory (tax) mechanisms or a mix of both, in order to achieve the pooling of risks. These mechanisms are social insurance, social assistance or universal benefit schemes.

- However, in some national contexts, “social security” is used as a synonym for social insurance and refers to mechanisms which are (1) financed through workers’ and employers’ contributions before the occurrence of the contingency; (2) based on the principle of risk pooling and solidarity; (3) inclusive of the notion of a guarantee (either in relation to benefits in cash or medical services).

- “Social protection” is at times considered in a narrower sense referring only to means-tested social assistance measures targeting the poorest, most vulnerable members of society, but also universal measures. However, it can also be seen as broader in character, integrating additional social services and measures such as those related to education, housing, and water and sanitation.

- The ILO emphasizes common commitment in building universal social protection systems, including social protection floors, that entail “actions and measures to realize the human right to social security by progressively building and maintaining nationally appropriate social protection systems, so that everyone has access to comprehensive, adequate and sustainable protection over the life cycle, in line with ILO standards”.

Does Convention No. 102 take into account schemes and programmes that lack a legal basis?

- A country that ratifies an international labour Convention undertakes to apply the Convention in national law and practice and report on its application at regular intervals. Convention No. 102 specifically requires all ratifying States to provide “full information concerning the laws and regulations by which effect is given to the provisions of the Convention” (Article 76). Conversely, schemes and programmes that do not have a legal basis cannot be used to demonstrate compliance with the provisions of the Convention.

- Convention No. 102, however, offers States considerable flexibility to determine matters through national law and regulation. For example, States could specify by law how and when an old-age pension may be suspended when the beneficiary continues to work. Similarly, national law should define the degree of permanent disability that gives entitlement to a disability pension.

- It is important for social protection systems to be built on strong legal frameworks, because they: (1) ensure that social protection is a right and not a matter of charity; (2) ensure programme stability and a long-term strategy; (3) contribute to predictability and sustainability; (4) facilitate distinction between rights-holders and duty-bearers; (5) uphold rights and builds in safeguards against arbitrary governance; (6) allow for more effective supervision by the State and public advocates (e.g. the ombudsman); (7) offer greater guarantees of broader social and public dialogue, due process and financing.

Can Convention No. 102 cover individuals who are not classified as employees?

- While it is often thought that Convention No. 102 concerns only the social protection of employees, it in fact recognizes that there are many ways to provide social protection. It establishes minimum levels of guaranteed protection not only for “employees” but also in respect of “economically active persons” and “residents whose means during a protected contingency do not exceed certain limits” or “all residents” in some specific cases. In other words, Convention No. 102 makes provision for mechanisms that provide wage-related benefits (i.e. social insurance schemes), flat rate benefits, and means tested benefits (i.e. social assistance schemes). In the case of medical care, Convention No. 102 also considers benefits based on residency (i.e. universal schemes).

- Convention No. 102 gives each State party the choice to determine which of these three mechanisms it will use to demonstrate compliance for each of the contingencies it has accepted. In other words, a State that has a social assistance scheme that provides sickness, unemployment and old-age benefits to persons with low incomes can use such a mechanism to demonstrate its alignment with Convention No. 102.

- Additionally, the Convention establishes minimum benchmark for each of these mechanisms, on the understanding that each country may go beyond these minimum levels and provide greater protection, in respect of both the persons protected and the level of benefits guaranteed by the national legislation. In short, Convention No. 102 concerns not only the protection of employees, but also of self-employed workers, persons with low incomes and residents (in the case of medical care).

What is the difference between contributory schemes and non-contributory schemes?

Contributory schemes

- Contributory schemes are those in which the contributions made by protected persons (actual or potential beneficiaries) and their employers directly determine entitlement to benefits (acquired rights). Social insurance schemes are the most common form of contributory social security schemes. Unlike commercial insurance, social insurance is not profit-oriented and aims to guarantee a certain standard of living and access to medical care by creating solidarity mechanisms between the scheme participants.

- Under these schemes, benefits are geared to the member’s previous earnings and the number of contributions paid – their contributory history–. A member usually has to demonstrate a certain number of contribution payments to be entitled to a benefit when a contingency occurs. The amount of the benefit also often depends on the beneficiary’s contribution history and previous income (for example, old age pensions might be calculated on the basis of average career earnings.

- In combination with other measures, the inclusion of workers operating in the informal economy into contributory social security mechanisms can be a powerful driver towards their transition to the formal economy. This also bolsters the potential and sustainability of the contributory system by broadening the pooling of risks. However, while the extension of contributory social security mechanisms helps alleviate pressures on tax-financed benefits, it might require a certain level of subsidization, at least at the beginning, to cover some or all of the contributions or benefit costs.

Non-contributory (tax-financed) schemes

- Non-contributory (tax-financed) schemes cover a broad range, including universal schemes for all residents (such as national health services), categorical schemes for certain broad groups of the population (e.g. children below a certain age or older persons above a certain age) and means-tested schemes (such as social assistance). Non-contributory schemes are usually financed through taxes or other State revenues (e.g. earmarked revenue) or, in certain cases, through external grants or loans. Benefits can be in cash or in kind.

- Means-tested benefit schemes play a key role in poverty reduction, provided that the benefits, together with other support measures, such as policies related to housing, education, water and sanitation and public transport, ensure that the nationally defined minimum income levels for providing adequate levels of protection are met. These may be equivalent to the accepted poverty line or the monetary value of a set of necessary goods and services.

- Non-contributory (tax-financed) schemes are especially relevant for persons not covered by contributory schemes, either because they have been working in the informal economy or have not met the conditions for entitlement to a benefit, as they can provide basic income security and access to health care, thereby securing a dignified life.

- The levels and range of social security benefits provided through non-contributory social protection mechanisms are usually unrelated to the levels of earnings in the country and thus lower than those enjoyed by workers affiliated to contributory social insurance. This applies mostly to benefits providing income security; the situation is different with respect to health protection. In many cases, benefit levels are inadequate to meet people’s needs. For this reason, the State should ensure that adequate non-contributory benefits are extended to all persons in need as part of a nationally-defined social protection floor , so as to guarantee that those not covered by contributory mechanisms have access at least to basic income security and essential care, and should also extend the coverage of contributory mechanisms, in particular through formalization policies, so as to ensure that more people can progressively receive better protection.

Is Convention No. 102 limited to social insurance schemes?

- Convention No. 102 does not advocate a one-size-fits-all model of social security. It enables each ratifying State to consider the most optimal combination of financing and administration methods and approaches to guarantee the protection required, as long as it complies with the minimum benchmarks and principles it sets out.

- Specifically, Convention No. 102 considers that social protection can be achieved through two main funding mechanisms, namely workers’ and employers’ contributions based on wages or earnings (i.e. social insurance schemes), and taxes (including provisions such as universal benefits and social assistance schemes), or a combination of both. As such, the application of Convention No. 102 is not limited to social insurance schemes.

- In practice, the boundaries between contributory and non-contributory/tax-financed schemes are often not clear. Social insurance schemes also benefit from a share of general revenue, for example to subsidize the contributions of those with low incomes or to cover the costs associated with benefits and their administration, either those foreseen by law or else ad hoc transfers to cover potential deficits.

- Experience shows that countries which have successfully achieved universal or near-universal coverage have often done so by using a mix of mechanisms and funding sources.

Can Convention No. 102 be implemented through targeted social assistance schemes?

- As mentioned above, Convention No. 102 recognizes that there is no single way of ensuring and administering social protection. It therefore provides for three main types of mechanism whereby States can show how they comply with the requirements of the Convention: schemes covering employees; schemes covering the economically active population; and means-tested schemes covering residents.

- It follows that States which provide sickness benefits, unemployment benefits, old-age benefits, child and family benefits, disability benefits and/or survivors benefits, through schemes covering all residents whose means during the contingency do not exceed the limits established by law (i.e. means-tested social assistance schemes), can use those schemes to show that they are aligned with the benchmarks and principles set out in Convention No. 102.

- In other words, social assistance schemes which target persons because their means fall below a certain threshold, can be used to apply Convention No. 102 provided that they are anchored in law and meet the coverage, qualifying conditions, levels and duration of benefits, and principles, set out in the Convention.

Can Convention No. 102 be implemented through employer liability or worker compensation schemes?

- Under direct employer liability schemes, compensation for a worker or their surviving family dependants is a legal liability placed upon the employer. Given that the financial burden of meeting this obligation rests solely on employers, the ILO social security standards do not incorporate such schemes, as they are not compatible with the principle of collective financing under which benefits are financed by contributions or taxation, or a combination or both. Collective financing is key to social security, because it facilitates both the pooling of risks and solidarity for workers and employers.

- Employer liability schemes can place an undue burden on employers, especially micro and small economic units. For example, a small enterprise might face difficulties in continuing to pay the salary of a woman during maternity leave while at the same time paying a salary for her replacement. This can lead to non-compliance and render the protection largely ineffective, for example in the event of the employer’s insolvency. In such cases, judicial review is the only recourse open to workers wishing to claim compensation, but such processes can be very lengthy and costly. Social insurance mechanisms therefore offer micro- and small economic units in particular an important risk-pooling and planning mechanism that allows them to stretch contributions for maternity and other benefits over a longer period of time in a more predictable way.

- Moreover, employer liability schemes can result in discriminatory practices. For example, employers may be unwilling to hire, retain or promote women of child-bearing age due to the potential costs of paying all or part of their wages during maternity leave, or persons with certain medical conditions for similar reasons relating to the payment of sickness benefits.

- In short, collectively financed mechanisms provide better protection, ensure greater equality of treatment, solidarity and risk sharing, and are aligned with Convention No. 102.

Can States limit their social protection provision to the minimum standards set out in Convention No. 102?

- Convention No. 102 is the social security minimum standard. This means that a State party may provide better protection above the minimum benchmarks set out in the Convention, for example by protecting more persons, setting higher replacement rates or providing benefits for longer durations, but its national law and practice should ensure, at the minimum, that benefits meet the established benchmarks at all times.

- The ILO Constitution clearly states that Member States should not use the ratification of a Convention to affect any right which ensures more favourable conditions to workers than those provided for in the Convention (Article 19(8)).

Can defined-contribution schemes be used to implement Convention No. 102?

The ILO social security standards do not rule out any type of scheme. In so far as a social security scheme or programme provides protection against social risks in the manner set out in the Convention and respects its principles, it may be deemed compliant with the Convention.

However, in most cases defined-contribution schemes also called individual savings accounts fail to comply with these fundamental principles and benchmarks in the following ways:

- Principle of minimum and defined benefit guarantee: To be in conformity, pensions are required to be paid periodically at a level at least equal to 40 per cent of previous earnings for any person earning equal to or less than a skilled worker as defined by the Convention. In most cases, defined contribution schemes do not offer statutory guarantees that the benefits will be adequate and predictable, as their level is related to market performance.

- Principle of periodic adjustment: Pensions should maintain their purchasing power over time through periodic adjustments which reflect changes in the cost of living. Typically, defined contribution schemes do not automatically provide annuitized benefits and, when they do, those benefits generally are not price-indexed. Pensioners thus bear an inflation risk under defined contribution schemes, whereas defined benefit schemes are usually indexed to prices or wages.

- Principle of benefits throughout the contingency: Benefits should be paid throughout the contingency. For example, in the case of old age, until the beneficiary is deceased. Under many defined contribution schemes, benefits are calculated on the basis of the capital that each insured person holds in his/her individual savings account, so that when the capital accumulated in that account is exhausted, entitlement to benefits may disappear even if the social risk continues. Under certain pension schemes, the national legislation may enable a pensioner to purchase a life annuity with their savings. However, in practice the life annuity market might be low or inexistent, since the insurance sector will not necessarily be interested in offering such financial instruments in view of the related long-term risk and uncertainty (i.e. the risk that the beneficiary lives longer than expected).

- Principle of collective financing: ILO social security standards are based on the premise that risks are shared among members of the community and not on the transfer of risks from the market to individuals. Therefore, benefits should be financed collectively through contributions or taxes or both, while ensuring that the total of insurance contributions payable by protected persons does not exceed 50 per cent of the total resources available for the protection of employees and their spouses and children. Generally, in defined contribution schemes the risks associated with investment in the financial markets, as well as labour market risks such as periods of unemployment or low income, are transferred to individuals, with a consequent disengagement of the State.

- Principle of participatory management: Social security should be administered jointly or in consultation with representatives of the persons protected, especially where the administration is not entrusted to an institution regulated by the public authorities or by a government department accountable to Parliament. In many cases, privately managed defined-contribution schemes do not permit affiliated members to participate in their management.

In particular, the Committee of Experts in the Application of Convention and Recommendations (CEACR) has observed that pension schemes based on the capitalization of individual savings managed by private pension funds are organized in disregard of the principles of solidarity, risk sharing and collective financing, which form the essence of social security, and also in disregard of the principles of transparent, accountable and democratic management of pension schemes featuring the participation of representatives of the insured persons.

Can voluntary insurance mechanisms be used to implement Convention No. 102?

- The underlying principle in the Convention, set out in its Article 6, is that of mandatory insurance. However, protection provided through voluntary insurance mechanisms can be exceptionally considered for the following contingencies: medical care, sickness, unemployment, old age, maternity (medical care only), invalidity, and benefits in case of loss of the family income earner. This is subject to the following conditions:

- The voluntary insurance scheme is supervised by public authorities or administered by social partners according to rules set out in national laws and regulations.

- The voluntary insurance scheme covers a substantial number of persons who earn as much or below the earnings of a representative person engaged in skilled manual labour (as defined by the Convention).

- The benchmarks and principles set out in the Convention are met, including those applicable to the minimum level and duration of the benefit.

- In practice, voluntary coverage leads to adverse selection, small risk pools and dysfunctional incentives. Many examples show that voluntary coverage rarely leads to a significant extension of effective coverage.

Are the levels and scope set out in Convention No. 102 adjusted to the reality of low- and middle-income countries?

- Convention No. 102 does not seek to establish a single international level of benefits that is the same for all country contexts. Rather, it recognizes that national circumstances differ and that what is regarded as an adequate level of benefits will vary from country to country. Therefore, in order to determine that the level of benefits in a country is adequate with respect to the benchmarks set out in Convention No. 102, it provides a mechanism designed to identify a relevant reference wage for the country in question. This ensures that the assessment reflects national realities.

- In recognition of the difficulties involved in implementing a comprehensive social protection system, especially in low- and middle-income countries, States can ratify the Convention even if their system does not yet cover all nine social risks. Provided their system covers three social risks and one of these is either unemployment, old-age, employment injury, invalidity or survivors’ benefits, they can ratify the Convention and expand their obligations as the social protection system develops.

- Also, recognizing that some national economies and medical facilities are still developing, Convention No. 102 contains flexibility clauses that allow countries, exceptionally and temporarily, to demonstrate compliance with lower benchmarks. This makes the standard more easily accessible to some low- and middle-income countries because, first, the scope can be limited to industrial enterprises instead of all economic sectors and, second, the scope can also be limited to larger enterprises, thus matching the pattern of social security development seen in many countries.

- In the same vein, low- and middle-income countries are enabled temporarily to implement Convention No.102 on the basis of a reduced medical package for employment injury, or to reduce the duration of the payment of benefits, for example in the case of sickness benefits.

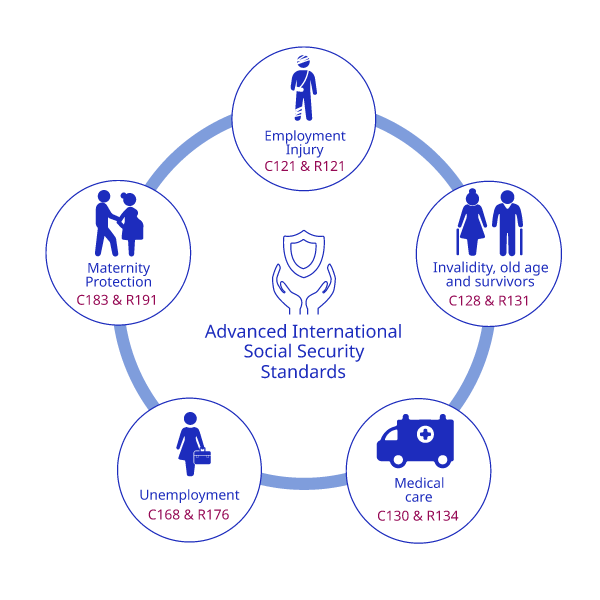

Convention No. 102 is the flagship convention establishing the minimum standards for social security, but are there other relevant international social security standards?

Building on the model established by Convention No. 102, ILO tripartite Members subsequently adopted five other Conventions, each accompanied by a Recommendation, which together establish higher standards of protection – in terms of the persons covered and the level of benefits - for eight of the nine contingencies covered by Convention No. 102. These include:

- The Employment Injury Benefits Convention, 1964 (No. 121) and its accompanying Recommendation No. 121;

- The Invalidity, Old-Age and Survivors’ Benefits Convention, 1967 (No. 128) and its accompanying Recommendation No. 131;

- The Medical Care and Sickness Benefits Convention, 1969 (No. 130) and its accompanying Recommendation No. 134;

- The Employment Promotion and Protection against Unemployment Convention, 1988 (No. 168) and its accompanying Recommendation No. 176;

- The Maternity Protection Convention, 2000 (No. 183) and its accompanying Recommendation No. 191.

- In addition, the Equality of Treatment (Social Security) Convention, 1962 (No. 118) and the Maintenance of Social Security Rights Convention, 1982 (No. 157) and its accompanying Recommendation No. 167, guide countries in operationalizing the right to social security to migrants and their families.

- Other Conventions and Recommendations, such as the Domestic Workers Convention, 2011 (No. 189), the Transition from the Informal to the Formal Economy Recommendation, 2015 (No. 204) or the Employment and Decent Work for Peace and Resilience Recommendation, 2017 (No. 205) also include relevant references to social security.

What is the Social Protection Floors Recommendation, 2012 (No. 202) and how it can help in extending social protection?

- As the newest addition to the body of international social security standards, Recommendation No. 202 on Social Protection Floors sets out a strategic vision of how to achieve universal social protection while taking into account the multiple gaps and challenges that exist in terms of coverage, adequacy and comprehensiveness of protection as well as financial sustainability. It does not replace, but complements, Convention No. 102 and the subsequently adopted higher standards, integrating them into this strategic vision.

- The strategy to close coverage gaps and achieve universal coverage is two-dimensional: (1) States should provide at least basic levels of protection to all in need through the implementation of a nationally defined social protection floor as a matter of priority; and (2) they should progressively ensure higher levels of protection to as many persons as possible guided by Convention No. 102 and higher international social security standards.

- Recommendation No. 202 also provides guidance on designing and implementing national social security extension policies and strategies as the main vehicle for achieving the universal social protection objective in line with the two-dimensional strategy. The adoption of such policies has the merit of placing social protection higher on the Government’s agenda and on a par with other major public policies, especially those on employment. It also facilitates coordination, coherence and integration with, in particular, economic, employment and tax policies.

Social protection floors (Part II of Recommendation No. 202)

- According to Recommendation No. 202, social protection floors are nationally defined sets of basic social security guarantees which secure protection aimed at preventing or alleviating poverty, vulnerability and social exclusion. At the minimum, the State should provide the following four guarantees: (1) access to essential health care throughout the life cycle; (2) basic income security for children ensuring access to nutrition, education, care and any other necessary goods and services; (3) basic income security for persons of active age who are unable to earn sufficient income, in particular in cases of sickness, unemployment, maternity and disability; (4) basic income security for older persons.

- Member States are able to design their own social protection floors and the basic social security guarantees on which they rest, using the most effective and efficient combination of schemes and benefits, in cash or in kind, while remaining mindful of national circumstances.

National Strategies for extending Social Security (Part III of Recommendation No. 202)

- The adoption and implementation of a national social protection policy is, according to Recommendation No. 202, the optimal way of building and maintaining a universal social protection system. Policymaking and implementation processes, based on tripartite participation with representative organizations of employers and workers as well as consultation with other relevant and representative organizations of persons concerned, are key drivers in identifying gaps in coverage and the comprehensiveness and adequacy of protection, establishing immediate and longer-term objectives, and in taking action with a view to reducing fragmentation and improving coordination between the various components of national social protection systems. They also increase national ownership and improve uptake, especially when undertaken through a participatory approach with social partners, and help to involve crucial actors, including ministries of finance. This can be important, for example in improving financial, fiscal and economic sustainability, including by ensuring that the required funding is duly allocated and scheduled.

- Recommendation No. 202 expressly sets out a sequential approach to the formulation and implementation of national social security extension strategies. This involves: (1) setting objectives reflecting national priorities; (2) identifying gaps in, and barriers to, protection; (3) seeking to close gaps in protection; (4) complementing social security with active labour market policies, including vocational training; (5) specifying financial requirements and resources; and (6) raising awareness about social protection floors and extension strategies through information programmes.

Monitoring progress (Part IV of Recommendation No. 202)

- Social protection systems require institutionalized monitoring mechanisms to track the performance of schemes and programmes and guide their improvement, where necessary. This includes regular monitoring of implementation and periodic evaluation, in particular through the collection, compilation and analysis of social security data. Such monitoring is more efficient when it is undertaken, together with their social partners, by the institutionalized bodies charged with this function, is guided by a national social protection policy, and sets time frames for implementation.

- Comprehensive data collection and analysis is a crucial element in informed and evidence-based policy- and law-making, as well as in effective implementation. This implies the availability of data on contributors and beneficiaries disaggregated by sex, age group, and rural and urban area of residence, and expenditure data disaggregated by function and type of expenditure.

Frequently Asked Questions

Browse through the most frequently asked questions below.

Contact us if you still have questions!

What is the difference between social security and social protection?

Does Convention No. 102 take into account schemes and programmes that lack a legal basis?

Can Convention No. 102 cover individuals who are not classified as employees?

What is the difference between contributory schemes and non-contributory schemes?

Is Convention No. 102 limited to social insurance schemes?

Can Convention No. 102 be implemented through targeted social assistance schemes?

Can Convention No. 102 be implemented through employer liability or worker compensation schemes?

Can States limit their social protection provision to the minimum standards set out in Convention No. 102?

Can defined-contribution schemes be used to implement Convention No. 102?

Can voluntary insurance mechanisms be used to implement Convention No. 102?

Are the levels and scope set out in Convention No. 102 adjusted to the reality of low- and middle-income countries?

Convention No. 102 is the flagship convention establishing the minimum standards for social security, but are there other relevant international social security standards?

What is the Social Protection Floors Recommendation, 2012 (No. 202) and how it can help in extending social protection?